Navigating financial data can be complex. Financial Fusion aims to make it simple.

This AI-powered tool offers real-time analytics and seamless integration with popular accounting software. In 2025, the need for efficient financial tools is greater than ever. Financial Fusion promises to transform complicated financial data into clear, actionable insights. Whether you’re a small business owner or a financial manager, understanding its pricing, pros, and cons is crucial. In this review, we dive into Financial Fusion’s features, pricing tiers, and benefits. We also explore potential drawbacks, helping you decide if this tool is right for your financial needs. Learn more about Financial Fusion and its offerings on the official website.

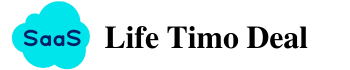

Credit: www.leewayhertz.com

Introduction To Financial Fusion

Financial Fusion is an innovative AI-powered financial tool designed to transform complex financial data into clear, actionable insights. This powerful tool integrates seamlessly with popular accounting software, making financial data management simpler and more efficient. In this section, we will delve into the basics of Financial Fusion, its purpose, and its target audience.

Overview Of Financial Fusion

Financial Fusion offers a comprehensive suite of features that streamline financial operations and enhance decision-making. Its main features include:

- AI-Powered Financial Insights:

- Real-time analytics for precise data analysis

- Visualization of trends and insights

- Real-time updates for better decision-making

- Customizable Reporting:

- Tailored report generation

- Highlight key metrics easily

- Seamless Integrations:

- Syncs with QuickBooks, Xero, Zoho, Excel, Airtable, Shopify

- Maintains smooth workflows

- Connects all data sources to save time

Purpose And Target Audience

The primary purpose of Financial Fusion is to provide businesses with deeper financial clarity and actionable insights. It is designed to help users create impactful reports and streamline financial operations. The tool is ideal for:

- Small to medium-sized businesses

- Accountants and financial managers

- Businesses looking to integrate various financial data sources

Financial Fusion is tailored for companies seeking to enhance their decision-making processes through real-time insights and customizable reporting. The different pricing tiers ensure that there is a suitable option for different business sizes and needs.

Pricing Details

| License Tier | Price | Features |

|---|---|---|

| License Tier 1 | $29 (originally $490) |

|

| License Tier 2 | $99 (originally $980) |

|

| License Tier 3 | $199 (originally $1,470) |

|

All pricing tiers come with a 60-day money-back guarantee, allowing users to try Financial Fusion for two months to ensure it meets their needs.

Key Features Of Financial Fusion

Financial Fusion offers a range of advanced tools to streamline your financial operations. This section explores the key features that make Financial Fusion an essential tool for modern financial management.

Comprehensive Financial Planning Tools

Financial Fusion includes a suite of comprehensive financial planning tools. These tools help users to manage their finances effectively. Users can create detailed financial plans and track their progress over time. The planning tools are designed to be intuitive and easy to use, ensuring that users can quickly set up and manage their financial goals.

Integrated Investment Management

With integrated investment management, Financial Fusion allows users to oversee their investment portfolios. The platform syncs with popular accounting tools such as QuickBooks and Xero. This integration ensures that all investment data is up-to-date and accurate. Users can monitor their investments and make informed decisions based on real-time data.

Advanced Risk Assessment

The advanced risk assessment feature of Financial Fusion provides users with critical insights into potential risks. This feature uses AI-powered analytics to evaluate financial data and identify trends that could pose risks. By understanding these risks, users can take proactive steps to mitigate them and ensure the stability of their financial operations.

Automated Budget Tracking

Financial Fusion’s automated budget tracking feature helps users stay on top of their finances. The platform tracks income and expenses automatically, providing real-time updates on budget status. Users can set up custom alerts to notify them of any significant changes, ensuring that they always have a clear picture of their financial situation.

User-friendly Interface And Experience

The user-friendly interface and experience of Financial Fusion make it accessible to users of all skill levels. The platform is designed with simplicity in mind, featuring a clean and intuitive interface. Users can easily navigate through the various features and tools without any prior training. This ensures that even those with limited financial knowledge can effectively manage their finances.

| Feature | Description |

|---|---|

| Comprehensive Financial Planning Tools | Create and track detailed financial plans. |

| Integrated Investment Management | Monitor investment portfolios with real-time data. |

| Advanced Risk Assessment | Identify and mitigate financial risks using AI analytics. |

| Automated Budget Tracking | Track income and expenses automatically. |

| User-Friendly Interface and Experience | Navigate easily with a clean and intuitive interface. |

Pricing And Affordability

Financial Fusion offers a range of pricing tiers designed to suit different business needs. The key selling points are its affordability and the value it brings to financial management through its AI-powered insights.

Pricing Tiers And Options

| License Tier | Price | Features | Suitable For |

|---|---|---|---|

| License Tier 1 | $29 |

|

1 company |

| License Tier 2 | $99 |

|

1 company |

| License Tier 3 | $199 |

|

Up to 5 companies |

Value For Money Analysis

Financial Fusion delivers significant value for its price. For a one-time fee, you gain access to powerful financial tools that can streamline operations and provide real-time insights. This is especially beneficial for small to medium-sized businesses that need to keep costs low while enhancing decision-making capabilities.

The customizable reporting feature alone justifies the investment, allowing businesses to generate impactful reports tailored to their needs. The seamless integration with popular accounting tools further adds to its value, saving users time and ensuring smooth workflows.

Comparison With Competitors

When compared to its competitors, Financial Fusion stands out due to its affordability and comprehensive feature set. Many financial tools on the market charge monthly fees, which can add up over time. Financial Fusion, with its one-time purchase model, proves to be more cost-effective in the long run.

Competitors often limit features in their lower-tier plans, but Financial Fusion includes all main features even in its most affordable tier. This makes it a more attractive option for businesses that need robust financial tools without breaking the bank.

Credit: www.facebook.com

Pros Of Financial Fusion

Financial Fusion has been a game-changer for many businesses. It brings numerous benefits that make managing financial data easier and more effective. Below, we highlight some of the key pros of using this AI-powered financial tool.

Holistic Financial Solutions

Financial Fusion offers a comprehensive suite of features. These include real-time analytics, customizable reporting, and seamless integrations. Businesses can gain deeper financial clarity and make informed decisions based on precise data analysis.

| Main Features | Benefits |

|---|---|

| AI-Powered Financial Insights | Real-time updates for enhanced decision-making |

| Customizable Reporting | Tailored report generation highlighting key metrics |

| Seamless Integrations | Syncs with QuickBooks, Xero, Zoho, and more |

Ease Of Use And Accessibility

One of the standout features of Financial Fusion is its ease of use. The platform is designed with user-friendliness in mind, ensuring that even non-experts can navigate it with ease.

- Intuitive interface

- Seamless navigation

- Easy data import and export

This accessibility makes it a valuable tool for businesses of all sizes. It simplifies complex financial data, making it easier to manage and understand.

Customization And Personalization

Financial Fusion allows for a high degree of customization. Users can tailor reports to meet specific needs and highlight the most important metrics.

- Customizable report templates

- Personalized dashboards

- Flexible data visualization options

This level of personalization ensures that businesses can get the most relevant insights. It enhances their financial reporting and decision-making processes.

Strong Security Measures

Security is a top priority for Financial Fusion. The platform implements robust security measures to protect sensitive financial data.

- Encryption of data

- Regular security updates

- Secure data storage

These measures ensure that users can trust the platform with their critical financial information. It provides peace of mind and confidence in the tool’s reliability.

Cons Of Financial Fusion

Financial Fusion offers many benefits. However, it does have some drawbacks. Understanding these cons will help you make a more informed decision.

Potential Learning Curve

Financial Fusion is a powerful tool. Its AI-driven insights and customizable reporting may be overwhelming for beginners. Users with limited experience in financial tools might face a steep learning curve. The AI-powered features require some understanding to fully utilize. While the interface aims to be user-friendly, navigating through its various functionalities can be challenging initially.

Pricing For Premium Features

Financial Fusion’s pricing structure is tiered. This can be a downside for some users. The initial one-time purchase for License Tier 1 is quite affordable at $29. However, more advanced features come at a higher cost. License Tier 2 and Tier 3 are priced at $99 and $199 respectively. These higher tiers offer more detailed reports and support for multiple companies. For small businesses or startups, these prices might seem high, especially if they only need basic features.

| License Tier | Price | Features |

|---|---|---|

| Tier 1 | $29 | Lite month-end report, profit and loss report |

| Tier 2 | $99 | Detailed reports, balance sheet, quarterly and yearly reviews |

| Tier 3 | $199 | All features of Tier 2, support for up to 5 companies |

Limited Customer Support Options

Financial Fusion provides valuable tools, but customer support options are limited. Users have noted that the support channels are not as robust as needed. There is a lack of dedicated support staff available for immediate assistance. This could be a significant drawback for users facing urgent issues. The 60-day money-back guarantee is reassuring, but ongoing support could be improved for better user experience.

Ideal Users And Scenarios

Financial Fusion offers robust tools for various users. Its AI-powered financial insights and seamless integrations make it a valuable asset. Here are the ideal users and scenarios for Financial Fusion.

Best For Financial Advisors

Financial advisors benefit greatly from Financial Fusion’s AI-powered financial insights. The tool provides real-time analytics and visualization of trends, helping advisors make data-driven decisions quickly.

- Real-time updates for enhanced decision-making

- Customizable reporting to highlight key metrics

- Seamless integration with QuickBooks, Xero, and other tools

This streamlined workflow allows financial advisors to focus more on client advisory and less on data management.

Suitable For Individual Investors

Individual investors can use Financial Fusion to gain deeper financial clarity. The tool’s tailored reports and intuitive insights help investors understand their financial health better.

- Visualization of trends and insights

- Real-time updates for better investment decisions

- Syncs with Excel and Airtable for easy data management

With Financial Fusion, investors can make informed decisions and manage their portfolios efficiently.

Use Cases For Small Business Owners

Small business owners can leverage Financial Fusion to streamline their financial operations. The tool’s seamless integration with accounting software ensures smooth workflows.

- Syncs with QuickBooks, Zoho, and Shopify

- Customizable reports for month-end and profit and loss

- Real-time insights for better financial management

Financial Fusion helps small business owners save time and focus on growing their business.

Credit: www.performancetoyotastore.com

Frequently Asked Questions

What Is Financial Fusion?

Financial Fusion is a financial management software designed to streamline budgeting, investments, and expense tracking. It offers various tools for personal finance and business use.

How Much Does Financial Fusion Cost In 2025?

Financial Fusion’s pricing in 2025 varies based on the plan. The basic plan starts at $20 per month, while premium plans offer additional features.

What Are The Pros Of Financial Fusion?

Financial Fusion offers user-friendly interface, comprehensive financial tools, and excellent customer support. It integrates seamlessly with other financial platforms, enhancing user experience.

What Are The Cons Of Financial Fusion?

Some users find Financial Fusion’s advanced features overwhelming. The premium plans can be pricey compared to competitors.

Conclusion

Financial Fusion offers valuable financial insights at an affordable price. The AI-powered tool simplifies data management, helping users make better decisions. With its seamless integrations and customizable reports, it fits various needs. Considering the pricing tiers, there’s a plan for everyone. Interested in trying Financial Fusion? Check out the product here. Explore its features and see if it suits your business needs.