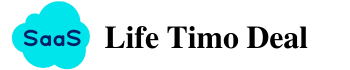

Generating credit repair leads can significantly boost your business. You need effective strategies to attract potential clients.

Credit repair is a vital service for many people. Bad credit can limit financial opportunities. To grow your credit repair business, you must find clients who need your help. This blog post will guide you on how to generate credit repair leads.

We will explore practical techniques to attract and convert leads. From online marketing to networking, these methods will help you reach more potential clients. Let’s dive into the steps to increase your credit repair leads and grow your business successfully.

Introduction To Credit Repair Leads

Generating credit repair leads is crucial for businesses in the credit repair industry. Quality leads can boost your business growth and help more clients. But what exactly are credit repair leads? These leads are potential clients who need help improving their credit scores. They seek services to remove negative items from their credit reports. Let’s dive deeper into why quality leads matter and the challenges in lead generation.

Importance Of Quality Leads

Quality leads are essential for any credit repair business. They are more likely to convert into paying clients. This increases your revenue and helps build a loyal customer base. High-quality leads often come from targeted marketing efforts. These leads are already interested in credit repair services. So, they are easier to convert compared to random leads.

Good leads also save time and resources. Your team can focus on genuine prospects instead of chasing uninterested people. This increases efficiency and productivity. Quality leads also improve your reputation. Satisfied clients are more likely to refer your services to others.

Challenges In Lead Generation

Generating credit repair leads comes with its own set of challenges. One major challenge is competition. Many businesses offer similar services, making it hard to stand out. You need unique strategies to attract and retain leads.

Another challenge is finding the right audience. Not everyone needs credit repair services. Identifying and targeting people with poor credit scores is crucial. This requires thorough market research and analysis.

Data privacy laws can also pose challenges. Collecting and storing personal information must comply with regulations. Failing to do so can lead to legal issues and damage your reputation.

Lastly, lead generation can be time-consuming. It requires consistent effort and monitoring. You need to track your campaigns and adjust strategies based on performance.

Identifying Your Target Audience

Identifying your target audience is crucial in generating credit repair leads. Knowing who your potential clients are helps tailor your marketing efforts. This ensures you reach people who need your services. Let’s delve into key aspects of identifying your target audience.

Demographic Analysis

Understanding demographics is the first step. Look at age, gender, and income levels. Check their education level and occupation. This gives a clear picture of your potential clients. For instance, younger adults may have different credit needs than older adults. Tailor your approach based on these factors.

Behavioral Insights

Behavioral insights are equally important. Study their spending habits. Are they frequent credit card users? Do they often seek loans? Understanding these behaviors helps predict their need for credit repair. Check their online activity. Do they search for financial advice or credit repair tips? This indicates their interest in your services.

Creating An Effective Marketing Plan

Creating an effective marketing plan is crucial for generating credit repair leads. A well-thought-out plan helps attract the right audience. It also ensures that your efforts bring measurable results.

Setting Clear Goals

Start by setting clear goals for your marketing plan. Identify what you want to achieve. Do you want to increase brand awareness or drive more leads? Be specific with your goals. For example, aim to gain 100 new leads in a month. This gives you a clear target to work towards.

Ensure your goals are measurable. This allows you to track progress. Use tools like Google Analytics to monitor your success. Adjust your strategies based on the data you gather. This helps improve your plan over time.

Budget Allocation

Allocate a budget for your marketing efforts. Determine how much you can spend. Consider the costs of different marketing channels. Social media ads, email campaigns, and content creation all require investment.

Prioritize your spending based on effectiveness. Focus on channels that bring the most leads. Track your spending to ensure you stay within budget. Adjust your allocations as needed to optimize results. This ensures your marketing plan remains cost-effective.

Utilizing Online Advertising

Generating credit repair leads is crucial for business growth. Utilizing online advertising can help you reach a larger audience. This section covers two effective methods: Search Engine Marketing and Social Media Campaigns.

Search Engine Marketing

Search Engine Marketing (SEM) is a powerful tool for credit repair leads. SEM involves using paid advertising to appear in search engine results. Here are some steps to get started:

- Keyword Research: Identify keywords potential clients use. Tools like Google Keyword Planner can help.

- Create Ads: Write compelling ads that attract clicks. Focus on benefits like “improve your credit score.”

- Set a Budget: Determine how much you can spend daily. Start small and adjust based on performance.

- Monitor and Adjust: Track your ad performance. Use analytics to improve your strategy.

Social Media Campaigns

Social media platforms are great for reaching potential clients. Platforms like Facebook, Instagram, and LinkedIn are ideal for advertising. Here’s how to create effective social media campaigns:

- Define Your Audience: Know who you want to reach. Consider age, location, and interests.

- Create Engaging Content: Use images, videos, and text. Make your content informative and engaging.

- Use Targeted Ads: Platforms allow you to target specific groups. This ensures your ads reach the right audience.

- Engage with Users: Respond to comments and messages. Build relationships with potential clients.

By leveraging SEM and social media, you can generate more credit repair leads effectively.

Content Marketing Strategies

Generating credit repair leads requires effective content marketing strategies. By sharing valuable content, you can attract potential clients and build trust. Focus on creating content that educates and informs your audience.

Blog Posts And Articles

Blog posts and articles are great tools for generating leads. Write about common credit repair issues and their solutions. Share tips on improving credit scores. Create lists and guides that your audience can follow easily.

Keep your content relevant and updated. Use keywords related to credit repair. This helps in attracting organic traffic from search engines. Engage your readers by asking questions and encouraging comments.

Use clear, concise language. Break up text with headings, bullet points, and images. This makes your content easy to read and understand. Consistency is key. Post regularly to keep your audience engaged.

Video Content

Video content is highly engaging. It can help you reach a wider audience. Create videos that explain credit repair concepts. Use visuals to illustrate your points.

Post these videos on platforms like YouTube. Share them on social media. Embed them in your blog posts and articles. This increases visibility and engagement.

Keep videos short and to the point. Use simple language. Include subtitles for better understanding. Encourage viewers to subscribe to your channel. Ask them to share your videos.

Engage with your audience through live sessions. Answer their questions in real time. This builds trust and establishes you as an expert in credit repair.

Leveraging Email Marketing

Leveraging email marketing can be a powerful way to generate credit repair leads. It allows you to reach potential clients directly in their inbox. With targeted email campaigns, you can build trust and offer valuable information. Here’s how to do it effectively.

Building An Email List

Start by creating a list of potential leads. You can gather emails through various methods:

- Offer a free guide or e-book on credit repair.

- Use opt-in forms on your website.

- Promote sign-ups on social media platforms.

- Attend events and collect emails in person.

Ensure your opt-in forms are simple and easy to fill out. Ask for minimal information initially. A name and email address are often enough. This reduces friction and increases sign-ups.

Crafting Engaging Emails

Once you have an email list, focus on creating engaging emails. Your emails should provide value and build trust. Here are some tips:

- Personalize your emails. Use the recipient’s name.

- Keep the content simple and easy to understand.

- Include a clear call-to-action. Guide the reader on what to do next.

- Use compelling subject lines. They should grab attention.

- Share success stories. Show how you have helped others repair their credit.

Consistency is key. Send emails regularly but don’t overwhelm your subscribers. Aim for once a week or bi-weekly emails. This keeps your audience engaged without being intrusive.

Below is an example of an engaging email template:

Subject: Boost Your Credit Score with These Simple Tips

Hi [Name],

Are you struggling with a low credit score? We understand how frustrating it can be. That's why we’ve put together some simple tips to help you improve your credit score.

1. Check your credit report regularly.

2. Pay your bills on time.

3. Keep your credit card balances low.

Want more personalized advice? Click here to schedule a free consultation with one of our experts.

Best regards,

[Your Name]

[Your Company]

Use this template as a starting point. Customize it to fit your brand and message. Always be transparent and honest in your communications.

Networking And Partnerships

Networking and partnerships are crucial for generating credit repair leads. Building relationships with the right people can help you reach a wider audience. This section will discuss how to leverage networking and partnerships to boost your lead generation efforts.

Collaborating With Influencers

Influencers have a significant following and can help promote your services. Partnering with them can increase your brand visibility. Here are some steps to collaborate with influencers:

- Identify influencers in the finance and credit repair niche.

- Reach out with a personalized message explaining your services.

- Offer value in exchange for their promotion, such as free services or a commission.

Collaborations can include social media posts, blog mentions, or video reviews. This helps you tap into their audience, generating more leads.

Joining Industry Groups

Industry groups are an excellent way to network with professionals. These groups can be found on platforms like LinkedIn, Facebook, or specialized forums. Here’s how to make the most of these groups:

- Join groups related to credit repair, finance, or small business.

- Participate actively by sharing valuable content and insights.

- Engage with other members by commenting and asking questions.

Being active in these groups can position you as an expert. This trust can lead to more referrals and business opportunities.

Tracking And Analyzing Performance

Generating credit repair leads is crucial for your business. But tracking and analyzing performance is even more important. Knowing how well your strategies work helps you make informed decisions. This ensures you get the best results from your efforts.

Key Metrics To Monitor

Monitoring key metrics is vital. These metrics show how well your lead generation strategies perform. Here are some important ones:

- Conversion Rate: The percentage of visitors who become leads.

- Cost Per Lead (CPL): The amount spent to acquire a lead.

- Lead Quality: The potential of a lead to convert into a customer.

- Return on Investment (ROI): The profit you gain compared to your spending.

- Website Traffic: The number of visitors to your site.

Adjusting Strategies Based On Data

Data is powerful. Use it to adjust your strategies. Here are steps to follow:

- Analyze your key metrics regularly.

- Identify which strategies are performing well.

- Pinpoint areas that need improvement.

- Make data-driven changes to your strategies.

- Track the impact of these changes over time.

Here’s a sample table to help you track and analyze your performance:

| Metric | Current Value | Target Value | Notes |

|---|---|---|---|

| Conversion Rate | 5% | 10% | Improve landing page design. |

| Cost Per Lead (CPL) | $50 | $30 | Optimize ad spending. |

| Lead Quality | Medium | High | Target specific audience. |

| ROI | 150% | 200% | Focus on high-performing channels. |

| Website Traffic | 2000 visits/month | 3000 visits/month | Enhance SEO efforts. |

Regular tracking and analyzing performance helps you stay on top. Keep adjusting your strategies based on data. This will ensure continuous improvement and better results.

Case Studies And Success Stories

Case studies and success stories provide valuable insights into generating credit repair leads. They offer real-world examples and lessons learned from businesses that have succeeded. By examining these stories, you can discover effective strategies and tactics to apply to your own lead generation efforts.

Real-life Examples

One credit repair company saw a 50% increase in leads. They focused on building trust with clients. Their strategy involved sharing customer testimonials on their website. This approach built credibility and attracted more leads.

Another company used social media to connect with potential clients. They posted helpful tips and success stories. This engagement led to a 30% boost in lead generation. Their audience felt more informed and motivated to seek help.

Lessons Learned

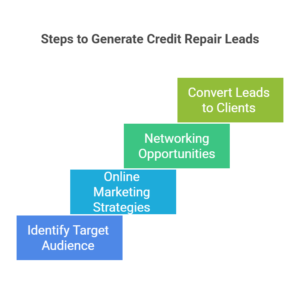

Consistency is key in generating leads. Regularly updating content keeps your audience engaged. This practice helps maintain a steady flow of leads.

Transparency builds trust with potential clients. Share your process and success stories openly. This honesty encourages more people to reach out for help.

Engage with your audience on multiple platforms. Use social media, email, and your website. Diverse touchpoints increase your chances of capturing leads.

Conclusion And Future Trends

Credit repair lead generation evolves with technology and consumer behavior. Expect to see more personalized marketing strategies and the integration of advanced AI tools. Staying updated on trends will ensure effective lead generation.

As the credit repair industry evolves, so do the methods for generating leads. Staying ahead of trends can give you an edge. In this section, we will summarize key points and explore emerging trends.

Recap Of Key Points

Generating credit repair leads requires a strategic approach. Here are the key takeaways:

- Optimize your website with SEO to attract organic traffic.

- Leverage social media platforms to engage with potential clients.

- Utilize email marketing for nurturing leads.

- Implement referral programs to encourage word-of-mouth marketing.

- Invest in paid advertising to reach a broader audience.

These methods form a solid foundation for attracting and converting leads.

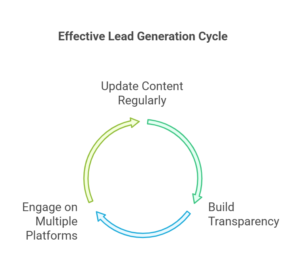

Emerging Trends In Lead Generation

New trends in lead generation are shaping the credit repair industry. Staying updated can help you stay competitive.

Here are some emerging trends:

| Trend | Description |

|---|---|

| AI and Chatbots | Using AI to interact with visitors and qualify leads. |

| Personalization | Tailoring content and offers based on user behavior and preferences. |

| Video Marketing | Creating engaging video content to attract and convert leads. |

| Mobile Optimization | Ensuring your website and ads are mobile-friendly. |

| Voice Search SEO | Optimizing for voice search to capture a growing segment of users. |

Incorporating these trends can enhance your lead generation efforts.

As the landscape changes, adapting to new strategies will be crucial. Keep experimenting with different tactics to see what works best for your business.

Frequently Asked Questions

How Can I Generate Credit Repair Leads?

To generate credit repair leads, optimize your website with SEO strategies. Use social media marketing and offer free resources. Networking and partnerships can also help.

What Is The Best Way To Attract Leads?

The best way to attract leads is by offering free consultations. Create valuable content, and use targeted advertising. Be active on social media.

How Do I Use Social Media For Lead Generation?

Use social media by creating engaging posts, running ads, and interacting with your audience. Share success stories and helpful tips.

Are Partnerships Effective For Generating Leads?

Yes, partnerships are effective. Collaborate with real estate agents, mortgage brokers, and financial advisors. They can refer clients needing credit repair services.

Conclusion

Generating credit repair leads takes time and effort. Focus on quality over quantity. Use social media to connect with potential clients. Build trust by offering valuable advice. A good website can attract more leads. Always follow up with interested prospects.

Keep your strategies simple and effective. Consistency is key in lead generation. Stay patient and persistent. Success will come with dedication.